Close up of young woman handling personal banking and finance with laptop at home

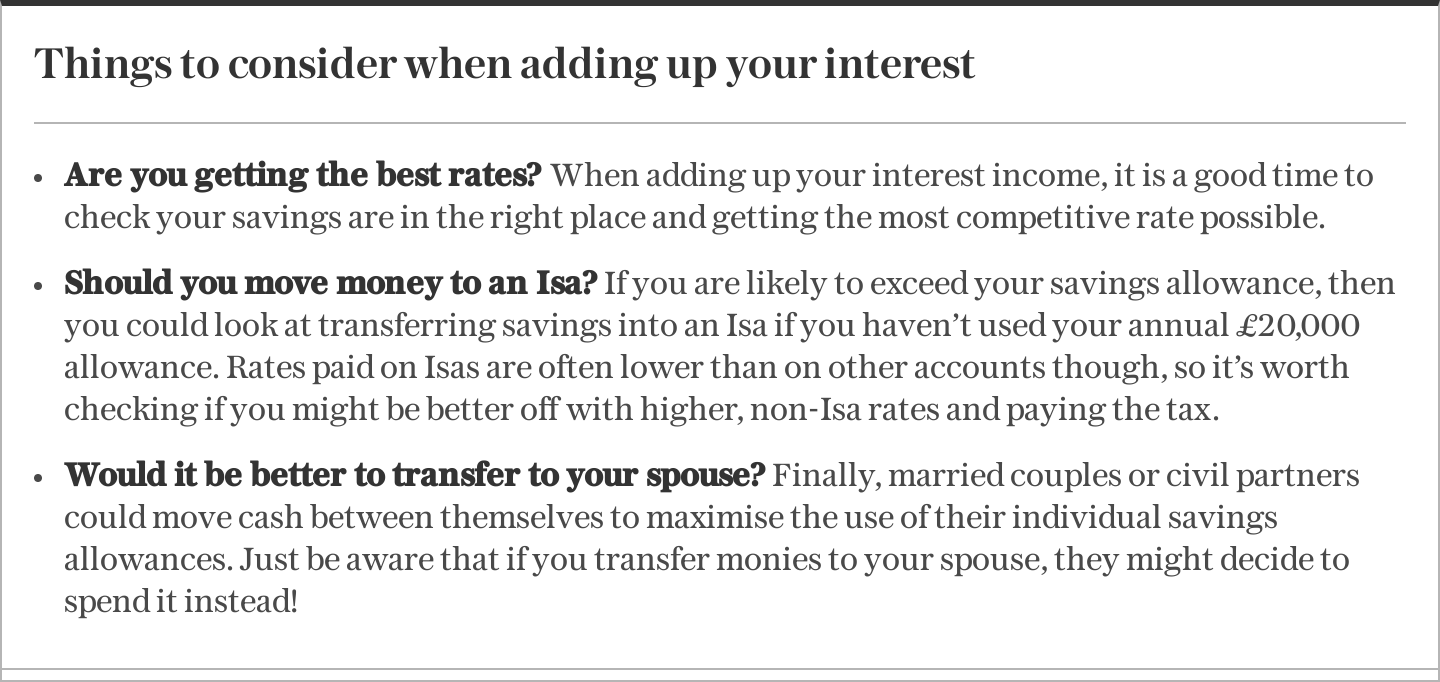

Savers putting money into NS&I’s new savings bond face being hit with a tax trap owing to a quirk of how the bonds work.

The British Savings Bond, which was announced by the Chancellor at the spring Budget and went on sale last week with an interest rate of 4.15pc, locks money away for three years.

But because the interest on the three-year fix is paid at the end of the term, savers will have to be careful to avoid being landed with an unwelcome tax bill, experts have warned.

Those who pay basic rate tax would need to put just £7,705 to get a tax bill. Higher-rate taxpayers would need to pay in just £3,852 to owe tax.

Savers have a £1,000 savings allowance before they start paying tax on their interest earnings. But if they are higher-rate taxpayers, they receive only £500, and additional-rate taxpayers have no savings allowance at all.

If more interest is earned in a year than the limit, then savers must pay tax on their money at their marginal tax rate.

If a saver puts in £10,000 for the three-year term, they will earn £415 in interest for the first year, £432 in the second and £450 in the third. The number increases because in the second and third years, savers will earn interest on top of the interest they earned the years before.

The interest that a saver would be paid would total £1,297 – and a tax bill would be due. For a basic-rate payer, this would be £60. But if the interest was paid out to savers annually, there would be no tax owed.

Sarah Coles, of online broker Hargreaves Lansdown, said: “Savers in the British Savings Bond who opt for the Guaranteed Growth Bond at 4.15pc could end up faced with a tax bill out of the blue.

“You can opt for the Guaranteed Income Bond instead, which pays a lower rate of 4.07pc and pays the interest monthly, so your interest is spread over three years for tax purposes. But why would you?”

Ms Coles said savers would do better using their entire £20,000 Isa allowance, and that even then they could still make more in other three-year fixes.

“The British Savings Bond was never designed to be a market-beating blockbuster. It’s a mid-market offering that NS&I expects to have around for the long term, delivering modest sums at a relatively low cost to the taxpayer,” she said.

Recommended

Use our tax on savings interest calculator to see how much you will pay

Read more

Laura Suter of brokers AJ Bell, said: “While NS&I’s Premium Bonds are tax-free, these British Savings Bonds aren’t. It means that you could pay tax on the interest you earn if you breach your personal savings allowance. You might already be at your limit, and so these bonds will tip you over the edge.”

She added: “What’s more, the top three-year fixed rate Isa is actually offering a higher interest rate than the NS&I bonds. UBL bank is paying 4.39pc, with a minimum savings of £2,000, while Shawbrook Bank pays 4.38pc on its three-year Isa with a lower £1,000 minimum saving.”

NS&I’s fundraising targets were increased in the spring Budget to £9bn for 2024-2025.

In 2023, the savings body tempted savers with a market-leading 6.2pc one-year fix, but the account was on offer for just six weeks before being pulled. Rates across the board have since dropped below 6pc.

The savings allowance is one of the tax thresholds that has been frozen until 2028. As interest rates rose after the Bank of England began raising the Bank rate in December 2021, more savers fell into the tax trap as they earned more on their money.

An NS&I spokesman said: “Guaranteed Growth Bonds are designed to be held for the full term and savers can only access the money, including compounded interest, at the end of the fixed-term, which is when any tax is due. HM Revenues & Customs outlines that any tax is paid on maturity when the person benefits from the interest earned on the fixed-term product.”

Recommended

Premium Bonds: how do you buy them and what are the chances of winning?

Read more

Play The Telegraph’s brilliant range of Puzzles – and feel brighter every day. Train your brain and boost your mood with PlusWord, the Mini Crossword, the fearsome Killer Sudoku and even the classic Cryptic Crossword.

News Related-

Up to 40 Tory MPs ‘set to rebel’ if Sunak’s Rwanda plan doesn’t override ECHR

-

Country diary: A tale of three churches

-

Sunak woos business elite with royal welcome – but they seek certainty

-

Neil Robertson shocked by bad results but has a plan to turn things round

-

Tottenham interested in move to sign “fearless” £20m defender in January

-

Bill payers to stump up cost of £100m water usage campaign

-

Soccer-Venue renamed 'Christine Sinclair Place' for Canada soccer great's final game

-

Phil Taylor makes his pick for 2024 World Darts Championship winner

-

Soccer-Howe aims to boost Newcastle's momentum in PSG clash

-

Hamilton heads for hibernation with a word of warning

-

Carolina Panthers fire head coach Frank Reich after 1-10 start to the season

-

This exercise is critical for golfers. 4 tips to doing it right

-

One in three households with children 'will struggle to afford Christmas'

-

Biden apologised to Palestinian-Americans for questioning Gaza death toll, says report