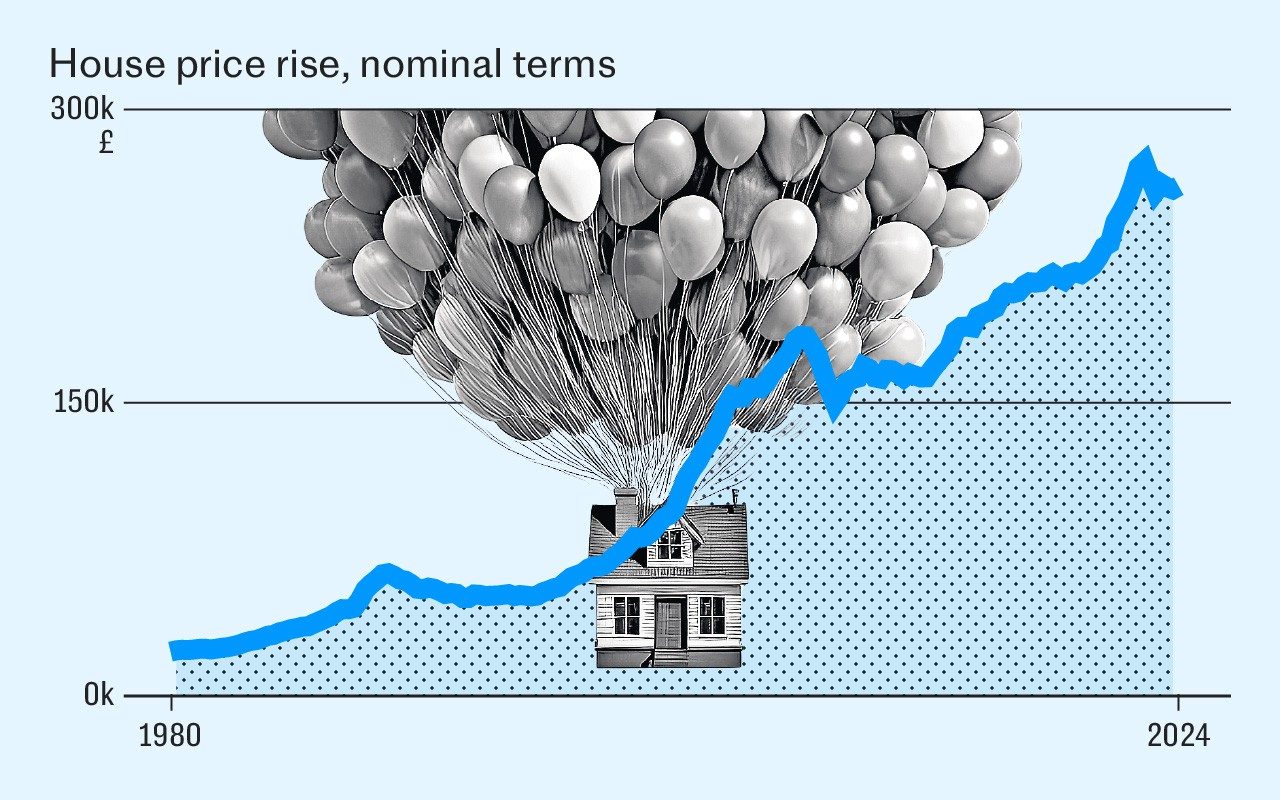

Can anything stop Britain’s bonkers housing market?

House Prices

Britain’s housing market is defying gravity.

Covid, recession and soaring mortgage rates have prompted prophecies of house price doom. But despite homeowners’ anxieties, the predicted crash hasn’t materialised.

The market may have cooled after prices reached an all-time high in 2022, but as the economic outlook improves analysts are adjusting their forecasts back to the status quo – rampant growth.

Savills now expects the average UK house price to rise by £61,500 over the next five years – a 21.6pc boost from £285,000 to £346,500.

The estate agent predicts 2.5pc house price growth this year, a hefty upgrade from its previous gloomy forecast of a 3pc drop, made in November when Britain was in recession.

Underpinning the forecast is the expectation that the Bank of England’s Bank Rate will fall from 5.25pc on Thursday to 2pc in 2028, making mortgages more affordable and allowing people to borrow more.

Lucian Cook, of Savills, said an improving economic outlook combined with “steady cuts” to the Bank Rate will boost house price growth from 2025.

He added: “There are headwinds – the general election, for instance, has the capacity to slow the market. But overall, the trend is for prices to keep rising.”

No more boom and bust?

If history is anything to go by, the housing market is heading in one direction – in the long run, at least. Inflation-adjusted house prices in Britain have risen by a staggering 365pc over the last 70 years.

But this sustained growth has been punctuated by several big slumps. The housing boom of the 1980s was brought to an abrupt end by a recession, double-digit interest rates and a wave of repossessions, fueled by a big rise in unemployment. Prices tumbled 37pc between 1989 and 1995.

An unprecedented and prolonged upswing followed, in which prices rose by 174pc between 1995 and 2007. Then came the subprime mortgage crisis in 2008 which wiped 26pc off the average house price over the next six years.

The history of devastating downturns cancelling out decades of equity gains has made commentators anxious about rising interest rates and a shaky economy in recent months.

But the housing market has proved remarkably resilient. Andrew Wishart, of Capital Economics, a research firm, said it is “surprising” that house prices have remained as high as they have.

He added: “One overlooked reason has been the shift towards longer mortgage terms – 25 years was the norm before the pandemic but now 35 or 40 years is common.

“It’s meant lower monthly repayments which has prevented people falling behind, and stopped repossessions and forced sales. It’s cushioned the impact on the housing market and the wider economy.”

Low unemployment

More than 1.5 million homeowners are due to reach the end of fixed-rate mortgage deals throughout 2024.

With the average two-year fixed-rate deal approaching 6pc, many are being forced to refinance at rates that are double what they are used to. In early 2022, average rates were well below 3pc.

This should mean strong downward pressure on house prices, as hard-up homeowners facing higher monthly repayments are forced to sell.

But banks have also become more cautious about who they lend to, and more willing to give borrowers the benefit of the doubt, Mr Cook said.

“Lenders have been very accommodating, and been reluctant to force homeowners into a position where they need to sell if they can’t afford a mortgage.

“The other factor is the regulated mortgage market. Banks have applied draconian stress tests for borrowers since the financial crisis. This has played a significant role in insulating the housing market, and stopped people from being forced to sell.”

In August 2022, the Bank of England relaxed these stress tests.

“Ironically, this also increases the capacity to boost house prices,” Mr Cook added, “as more people can now be approved for a mortgage.”

For Simon Rubinsohn, of the Royal Institution of Chartered Surveyors, the crucial difference between historic house price crashes and the situation today is the strength of Britain’s labour market.

He said: “After the downturn in early 1990s, it took a long time for the market to recover – you saw unemployment rise from 1.5 milion to three million [between 1989 and 1992].

“Banks hadn’t been through this environment before where there was massive potential for negative equity.

“You saw a wave of repossessions on an unprecedented scale and a lot of unwanted homes on banks’ books. In real terms, there was a substantial decline in prices.

“But this time unemployment has remained low, so you haven’t had those sorts of pressures.

“Now, it’s an interesting mix as you have interest rates going up, but banks have adjusted their behaviour. They are less willing to repossess, and there have been escape routes for mortgage owners in difficulty.”

It would take a collapse in employment to prompt a similar housing crunch today, according to Mr Wishart.

“The worst case scenario would be sustained high inflation, meaning interest rates can’t come down, and a large rise in unemployment from a deep recession – which isn’t on the agenda.

“High interest rates haven’t been enough on their own. Combined with rising unemployment, they might be.”

Throttled supply

The cause of buoyant house prices “isn’t difficult to identify”, according to Robert Colvile, director of think-tank the Centre for Policy Studies.

He said: “We haven’t built enough houses, in particular in high demand areas like London and the South East.

“In the short term, interest rates drive the markets but beyond that, the lack of supply keeps prices high.”

The Centre for Cities think tank estimates that Britain has built 4.3 million fewer homes than the average European country as a result of its broken planning system.

Last year, Britain built 234,000 new homes, more than at any point in the previous four years but well below the Government’s 300,000 per year target.

And the figures are about to get much worse. Between July and September, the number of housing starts – a key lead indicator for future completions – fell by 68pc compared to the previous three months and were down 52pc year-on-year.

Mr Cook agrees that limited housing stock is a key reason behind house prices rising – and the expectation is that the trend will continue.

He said: “The UK housing market is fundamentally undersupplied to meet demand. There is a structural imbalance between supply and demand and this is always going to be inflationary when it comes to house prices.

“On top of this, philosophically, the English public is wedded to the idea of homeownership for financial security – this also underpins demand.”

Labour’s plans

Sir Keir Starmer has vowed to turbo-charge housebuilding in Britain with a pledge to oversee 1.5 million new homes within five years of taking office.

But as Mr Wishart points out, a house price slump driven by a deluge of new homes is unlikely.

He said: “Supply moves more slowly than demand. We can only build 1pc to 2pc of housing stock each year, so supply is going to be quite slow-moving.

“Over the long-term it would definitely make a difference. But this will take decades, and in the shorter term demand – influenced by interest rates and unemployment – is going to be a much bigger factor.”

Mr Cook added: “It’s going to be very difficult for any government to bring house building up to 300,000. It’s going to be like turning a tanker ship.

“We’ve been underdelivering for a very long time, so you need to deliver lots to dent the underlying pressure on prices.”

Recommended

Why now is the best time to buy a house

Read more

Play The Telegraph’s brilliant range of Puzzles – and feel brighter every day. Train your brain and boost your mood with PlusWord, the Mini Crossword, the fearsome Killer Sudoku and even the classic Cryptic Crossword.