This story is part of CNBC Make It’s Millennial Money series, which details how people around the world earn, spend and save their money.

By their early 40s, Jenna Bhaloo and Neil Desai plan to attain a net worth of $2.5 million.

That’s how much the couple — who are currently both 30 with no children — estimates they’ll need to reach financial independence.

For them, that means “being able to make changes in our life, whether that means taking a sabbatical for six months or doing another career change just because we can. That’s what we’re interested in, and not having to worry about where the money is coming from,” Bhaloo tells CNBC Make It.

With around $885,500 currently invested, they’re well on their way.

Bhaloo and Desai both came into the relationship with healthy financial habits. But as they’ve grown together and gotten married, they’ve been focusing on establishing and chasing money goals as a team.

Bhaloo and Desai had been dating for 10 years when they tied the knot in 2023.

Together, they earned $227,071 in 2023. Bhaloo brought in $69,314 between working part-time while finishing her master’s of business administration in the beginning of the year and going full-time in July. Her annual salary is $125,000. Desai earned around $158,000 working in tech.

And while they’re working hard to reach financial independence, they’re not excessively limiting their lifestyle now to get there.

“You should be able to enjoy your life and experience all the things that you want to experience,” Bhaloo says. “You can have [your] investments go to work for you while you’re enjoying [life] and spending on the things that you love.”

Three degrees, debt-free

Holding two master’s degrees and a bachelor’s, Bhaloo is fortunate to not have any debt from her academic journey. A full-ride scholarship paid for her undergraduate studies and part of her master’s in public health from Boston University, where she graduated in 2016. Her parents helped cover the rest of the costs of her graduate studies at BU.

To earn her MBA from Duke University’s Fuqua School of Business in 2023 without taking on debt, Bhaloo relied on a combination of scholarships, savings, part-time jobs and help from her parents. She earned $80,000 a year prior to starting business school.

Bhaloo spent five years working in public health before going to business school and pivoting her career to renewable energy.

By working part-time during school, she wasn’t just earning money — around $30,000 during her first year — but valuable connections as well. The internship she held during her second year turned into a full-time job with the same company she works for now.

“My parents have always really emphasized education over anything else,” Bhaloo says. “They were very willing and happy to help pay for my tuition and living expenses.”

Bhaloo and Desai got married as she was finishing her MBA in 2023. Soon after, Desai decided he wanted to go to business school himself.

Although the couple’s finances were separate and Desai didn’t support Bhaloo financially while she was in school since they weren’t yet married, he provided much-needed encouragement and care.

“Neil was super supportive in making sure that I had everything that I needed at home taken care of so that I could focus on school and making this big life change,” Bhaloo says.

Things are different now that the couple is married while Desai is in business school. Desai and his parents are paying for his tuition, so it has factored into the couple’s joint budget. That’s OK with Bhaloo — she says this step for Desai has helped them shape up their future plans.

“Now that I’m done with school and Neil is in school, we’ve been able to plan [for the future] a little bit more and and think, ‘We’re married now, what are our goals as a couple?'” she says.

How they spend their money

As they identify their goals, the couple has made it priority to live below their means. They could afford to rent a larger apartment, for example, but choose to stay in their current place, Bhaloo says. The couple “constantly evaluates” how much they feel comfortable spending on rent or a future mortgage.

A functional kitchen was a non-negotiable when Bhaloo and Desai were looking for an apartment.

The $3,300 monthly rent for their 2-bedroom apartment is a little higher than Chicago’s average of $2,744 among 2-bedroom units, according to Zumper. But it’s still just 17% of Bhaloo and Desai’s annual joint earnings — well below the expert recommendation to keep your rent at or below 30% of your income.

“[Rent] is such a big portion of your expenditures that if you can control that number, then you can set up the rest of your year to spend on the other things that you enjoy doing,” Bhaloo says.

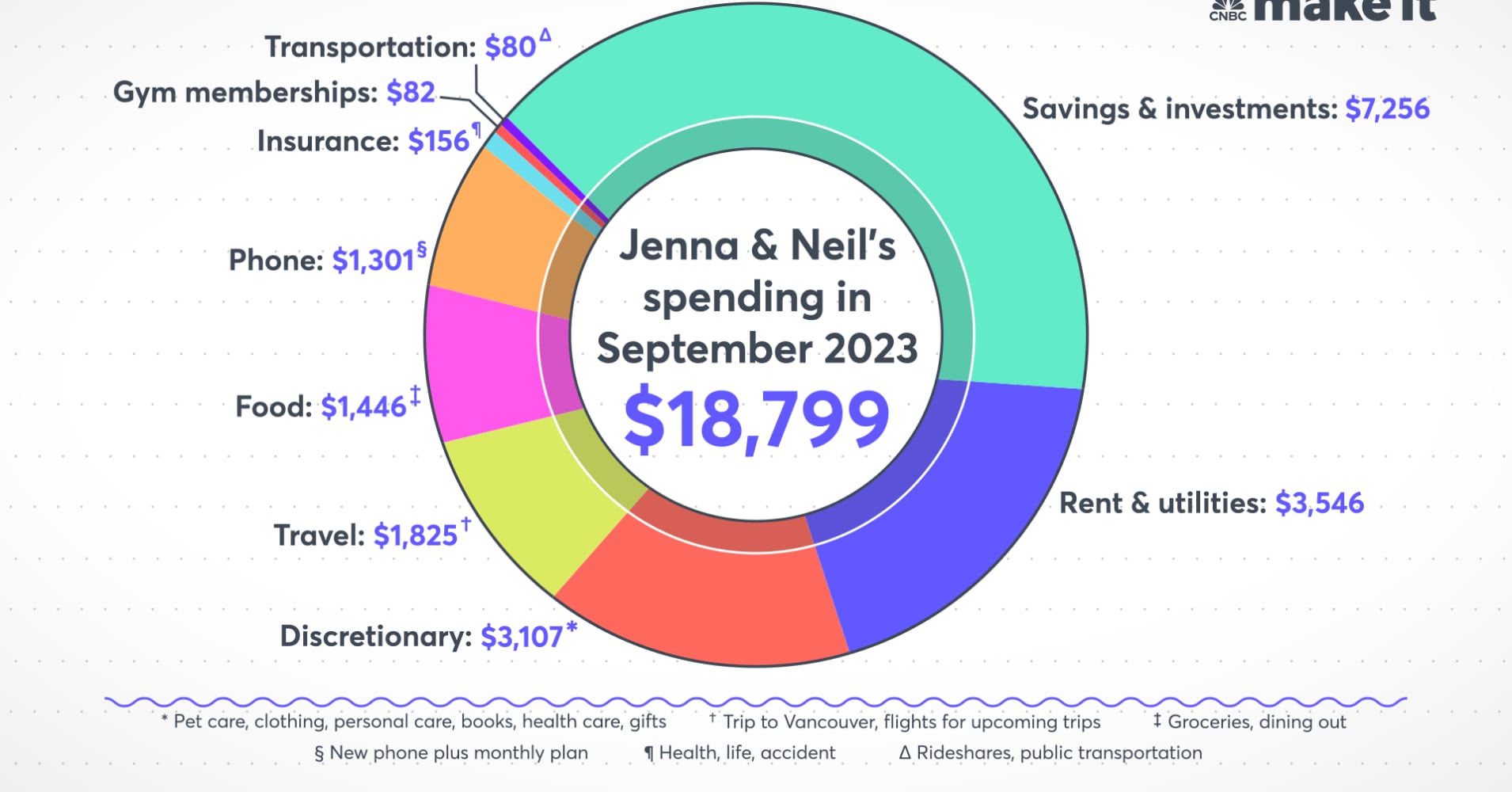

Here’s how Bhaloo and Desai spent their money in September 2023:

- Savings and investments: $7,256 in combined 401(k) contributions

- Housing and utilities: $3,546 on rent, gas, electricity, water and internet

- Discretionary: $3,107 for pet care, clothing, personal care, books, health care, gifts for friends and wedding thank you notes

- Travel: $1,825 during a trip to Vancouver and flights for upcoming trips

- Food: $1,446 on groceries and dining out

- Phone: $1,301 includes Bhaloo’s new phone purchase and monthly plan

- Insurance: $156 for health care through Desai’s employer

- Gym memberships: $82

- Transportation: $80 for public transportation and rideshares

Bhaloo received three paychecks in September, making her monthly 401(k) contribution higher than normal.

The couple say using the budgeting app Tiller to track their spending and have a central location to see their full financial picture has helped them merge their joint expenses.

“Instantly, we could see together what our net worth was, what our transactions were, how much Neil was charging onto his credit card, how much I was charging onto my credit card,” Bhaloo says. “Using a system that allowed us to combine and really see our accounts together was extremely helpful.”

The couple charges many of their expenses to credit cards to earn rewards, but pays them off each month, continuing to live debt-free.

Learning how Desai spends his money also helped Bhaloo focus on the things that are most important to them as a couple, she says.

“One of the things that really surprised me about Neil’s spending habits was that he really only spent on the things that he genuinely loved and would make investments into those items,” she says.

Desai bought a piano in 2020, for example. Bhaloo says seeing him willing to invest in a “well-made, high-quality” one helped her understand “the importance of really spending on the things that you love and cutting out spending money on the things that don’t bring you joy and happiness.”

Bhaloo and Desai love trying new restaurants and exploring different cuisines.

Food and travel are two of the spending areas Bhaloo and Desai prioritize, and they aren’t afraid to splurge a little here and there.

“One of the things that’s really important to us is to make sure that we enjoy our lives today, and not wait until we’re 60,” Bhaloo says. “For us, that means traveling. That means cooking really wonderful foods and dining out.”

As remote workers, they are enjoying the opportunity to work from wherever and hope to continue exploring different cities. They may even move abroad for a period in the future.

‘Striving for better and making tweaks along the way’

While both Bhaloo and Desai had pretty solid financial foundations from their families, they’re continuing to increase their financial literacy by reading books and checking out their favorite financial educators’ YouTube channels.

Bhaloo and Desai love taking their dog, Rumi, to the park.

“Financial health is an ongoing process,” Bhaloo says. “It’s never going to be perfect, but you can always [be] striving for better and making tweaks along the way as your life changes.”

They’re fans of Ramit Sethi’s book and Netflix show, which inspired them to think about what their “rich life” looks like. Continuing to pursue their love of traveling is definitely on the agenda, and Bhaloo says hiring a personal chef would be a luxury they’d love to explore.

Their next steps aren’t completely mapped out yet, but they say that’s part of the fun. Once Desai finishes his MBA, the couple “definitely” wants to move abroad for some time, but where exactly is to be determined.

“From there, we’ll see where life takes us,” she says. “We could come back to Chicago, we could also move anywhere else. There’s so much excitement in that unknown.”

What’s your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Want to land your dream job in 2024? Take CNBC’s new online course How to Ace Your Job Interview to learn what hiring managers are really looking for, body language techniques, what to say and not to say, and the best way to talk about pay. Get started today and save 50% with discount code EARLYBIRD.

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB