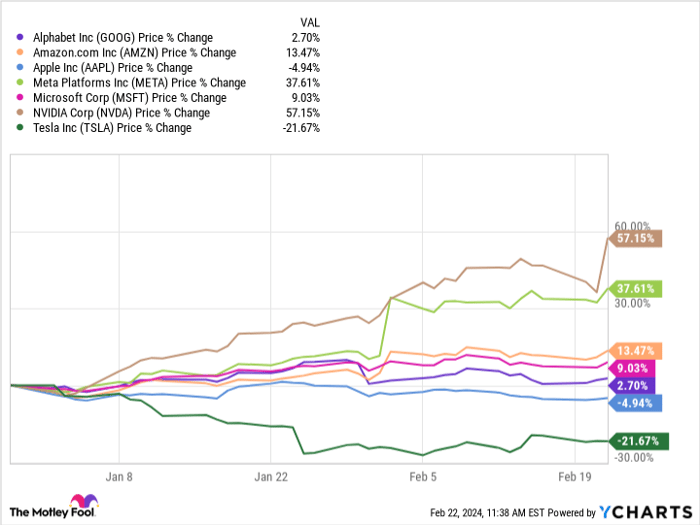

The stocks known as the “Magnificent Seven” has had a pretty mixed start to the year. This group includes high-profile tech companies that delivered excellent returns over the past decade: Alphabet, Amazon, Apple (NASDAQ: AAPL), Meta Platforms, Microsoft, Nvidia, and Tesla.

Some of them, most notably Meta Platforms and Nvidia, have been outperformers since January, while others haven’t had the same luck. Apple is in the latter category — the stock is down by nearly 5% year to date, the second-worst performance in the group.

Still, that’s no reason to ignore Apple stock. Let’s find out why Apple remains an excellent pick for long-term investors.

GOOG

Apple’s quarterly update wasn’t great

Apple’s shares fell following the release of its financial results for the first quarter of 2024, which ended Dec. 30, 2023. The tech giant’s results were not great, especially on the top line. Net sales increased by just about 2% year over year to $119.6 billion. Apple’s earnings per share did increase by a solid 16% year over year to $2.18. There’s a reason why investors weren’t happy with Apple’s quarterly report: The company’s performance in one crucial region looks worrisome.

That region is China. Apple’s sales in the country declined by 13% year over year to $20.8 billion — that’s roughly 17.4% of Apple’s first-quarter 2024 revenue. Apple blamed lower sales of the iPhone and several other devices for the decline. However, this shouldn’t be a long-lasting problem for Apple. Smartphone sales fell in China for much of last year partly due to economic issues.

Apple likely wasn’t the only company affected. Moreover, Apple remains the top-selling smartphone brand in the country and elsewhere. CEO Tim Cook recently noted, “According to a survey from Kantar, iPhones were four out of the top five models in the U.S. and Japan, four out of the top six models in urban China and the U.K., and all top five models in Australia.”

There are two more reasons to look at Apple’s first-quarter results with more optimism, especially concerning its performance in China.

First, this period included 13 weeks compared to the 14 weeks from the previous fiscal year’s parallel quarter. Second, currency exchange-rate fluctuations negatively impacted Apple’s sales growth metrics in China.

At any rate, the economic slowdown in China won’t last forever. More importantly, Apple has plenty of growth opportunities to exploit over the long run.

Plenty of growth opportunities ahead

Apple’s iPhone category remains the largest by revenue. In Q1 2024, the company’s iPhone sales increased by about 6% to $69.7 billion. No other segment of the company did better in terms of revenue growth except Apple’s services unit. Services sales grew by 11.3% year over year to $23.1 billion. While it still accounts for around 19% of Apple’s revenue, the services segment might be the most important for the company’s future.

Apple boasts an installed base of 2.2 billion devices and exceedingly high customer loyalty, which grants it the opportunity to create increasing, high-margin, recurring revenue from the suite of services it offers, from health-related apps to video and music streaming and more.

There’s one key opportunity Apple is currently trying to get in on: artificial intelligence (AI).

Cook was a bit tight-lipped on the matter during the company’s latest earnings conference call, only saying: “As we look ahead, we will continue to invest in these and other technologies that will shape the future. That includes artificial intelligence where we continue to spend a tremendous amount of time and effort, and we’re excited to share the details of our ongoing work in that space later this year.”

Apple is unquestionably trailing some of its peers in the potentially highly lucrative AI market. Microsoft and Alphabet are way ahead.

Still, it’d be unwise to bet against Apple here. After all, it has made it a business — and a highly successful one at that — to put its own tweak on existing technologies. Apple generates enough money to pour into research and development (R&D) and make headway into this space.

Apple has $106.9 billion in free cash flow. But whether within AI, healthcare, fintech, or some other area, the company has multiple growth paths that should enable it to remain successful for a long time.

So, Apple’s recent issues in China are by no means a deal breaker. If anything, long-term investors should take this opportunity to scoop up the company’s shares while it lags most of its Magnificent Seven peers year to date.

SPONSORED:

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 26, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Prosper Junior Bakiny has positions in Amazon and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

News Related-

Google Pixel 8 Pro Review: Is this the best Android phone of 2023?

-

Namwater Dam Bulletin on Monday 27 November 2023

-

Dr Yunus appointed chair of Moscow Financial University's international advisory board

-

Victory over Nigeria puts Uganda on the brink

-

BoG holds policy rate at 30%, tightens liquidity measures

-

When sea levels rise, so does your rent

-

American International School CEO honoured as ‘Icon of Inspiration and Impact’

-

Sierra Leone prison breaks co-ordinated - minister

-

Address the rise of single parenthood

-

Hyundai Chief Picked as Auto Industry Leader of the Year

-

Unmarried People Under 35 Outnumber Married Ones

-

European interior ministers in Hungary to discuss migration

-

Japan on the watch for unlicensed taxis around Narita airport amid foreign tourism spike

-

ECOWAS to send high-powered delegation on solidarity visit to Sierra Leone