Aadhar Housing Finance IPO: 10 key risks investors should know before subscribing to the issue

Aadhar Housing Finance IPO, backed by private equity major Blackstone, received 1.48 times subscription on the second day of bidding on Thursday. The quota for non-institutional investors received 1.94 times subscription while retail investors category got subscribed 94%. The portion for Qualified Institutional Buyers fetched 2.05 times subscription.

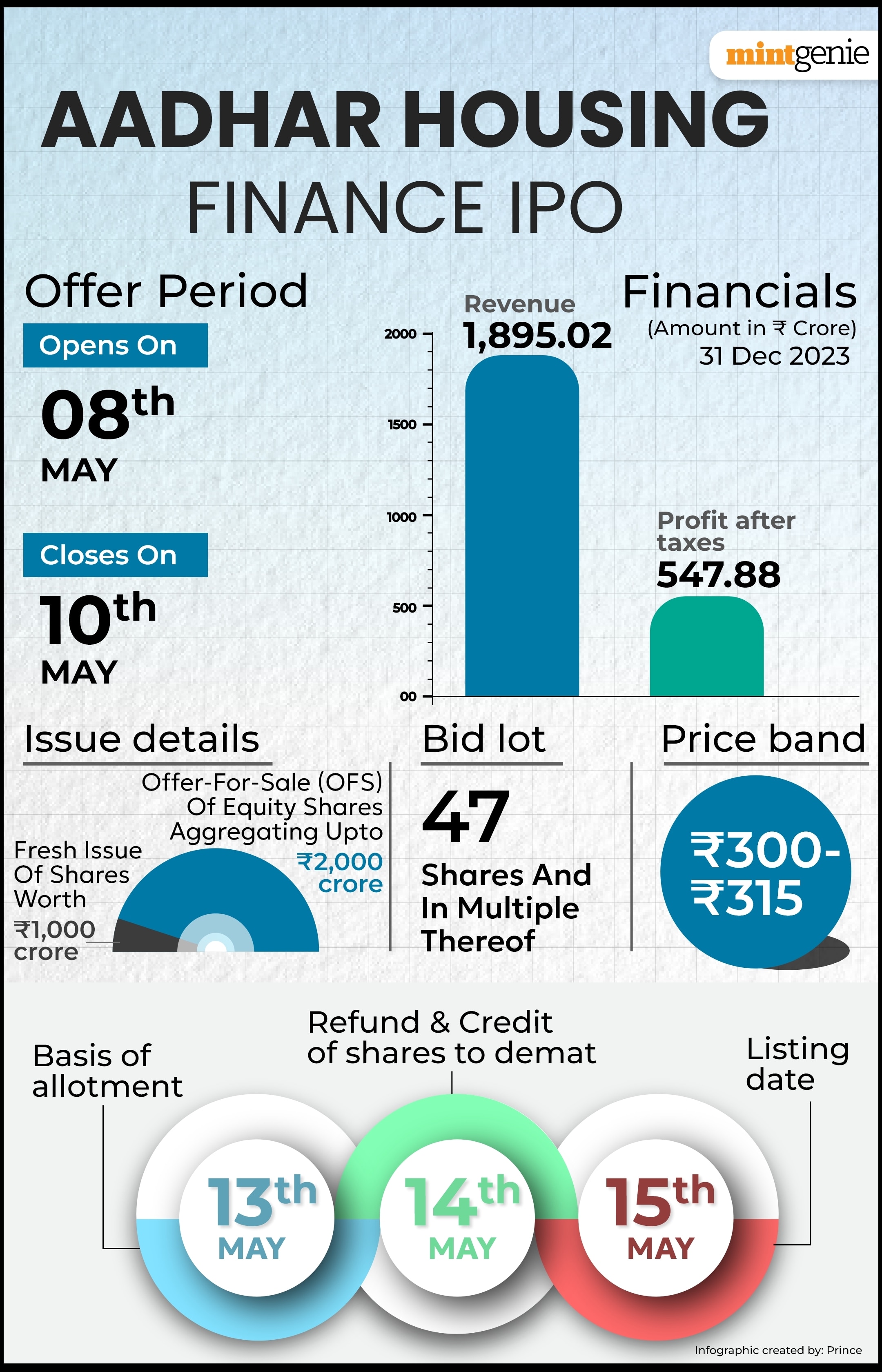

The Aadhar Housing Finance IPO consists of an OFS (Offer for Sale) of ₹2,000 crore made by promoter BCP Topco VII Pte Ltd, a subsidiary of Blackstone Group Inc., in addition to a new offering of equity shares valued at ₹1,000 crore.

On Tuesday, Aadhar Housing Finance Limited said that it had raised ₹898 crore from major investors.

A portion of the proceeds from the fresh offer would be utilised for general corporate purposes, while the remaining ₹750 crore will be used to fulfill future capital requirements for onward lending.

Aadhar Housing Finance provides a variety of mortgage-related loan products, including as loans for the acquisition and construction of commercial real estate, home remodelling and extension loans, and loans for the purchase and building of residential real estate.

Aadhar Housing Finance IPO details.

Here are some of the key risks listed by the company in its Red-Herring Prospectus (RHP):

- The former promoters of the finance service commercial company are the focus of ongoing regulatory investigations by enforcement organisations, such as the Enforcement Directorate. The results of these investigations could have a negative effect on both the promoters, BCP Topco, and the market value of the company’s equity shares.

- The commercial financing service firm relies on the quality and accuracy of the data that our third-party service providers and prospective borrowers submit. Their assessment of potential borrowers’ creditworthiness and the value and title of the collateral may be impacted by their reliance on any false information provided by them, which might have an impact on their business, operational outcomes, cash flows, and financial situation.

- The business has had negative net cash flows in the past and could do so in the future.

- Any rise in the percentage of non-performing assets in their AUM would have a negative impact on their operations, cash flows, business, and financial health.

- The firm is susceptible to interest rate volatility, and in the future, interest rate and maturity mismatches between our assets and obligations might result in liquidity problems.

- The company’s capacity to do business and activities may be negatively impacted by its debt and the terms and limitations imposed by its financing arrangements.

- Regulations and recommendations published by regulatory bodies in India, such as the NHB and RBI, must be followed by the firm; failure to do so might result in higher compliance costs, a diversion of management’s focus, and fines.

- Any potential increase in provisioning brought on by a rise in non-performing assets (NPAs) or the implementation of stricter guidelines for loan loss provisioning might lower their profit after taxes and have a negative effect on their operational outcomes.

- The company’s registered office and corporate office are the only branches, sales offices, regional offices, and corporate offices that it owns. Their commercial and operational outcomes may suffer if they terminate or fail to renew the lease, leave, and licensing agreements in a timely and favorable manner, or at all. Furthermore, it’s possible that many of the lease, leave, and licensing agreements they sign are not properly registered or stamped.

- Any unfavourable developments pertaining to the Indian real estate industry may have a detrimental impact on the collateral value for their loans, their business, and their operational outcomes.

Disclaimer: The views and recommendations above are those of individual analysts, experts and broking companies, not of Mint. We advise investors to check with certified experts before making any investment decisions.