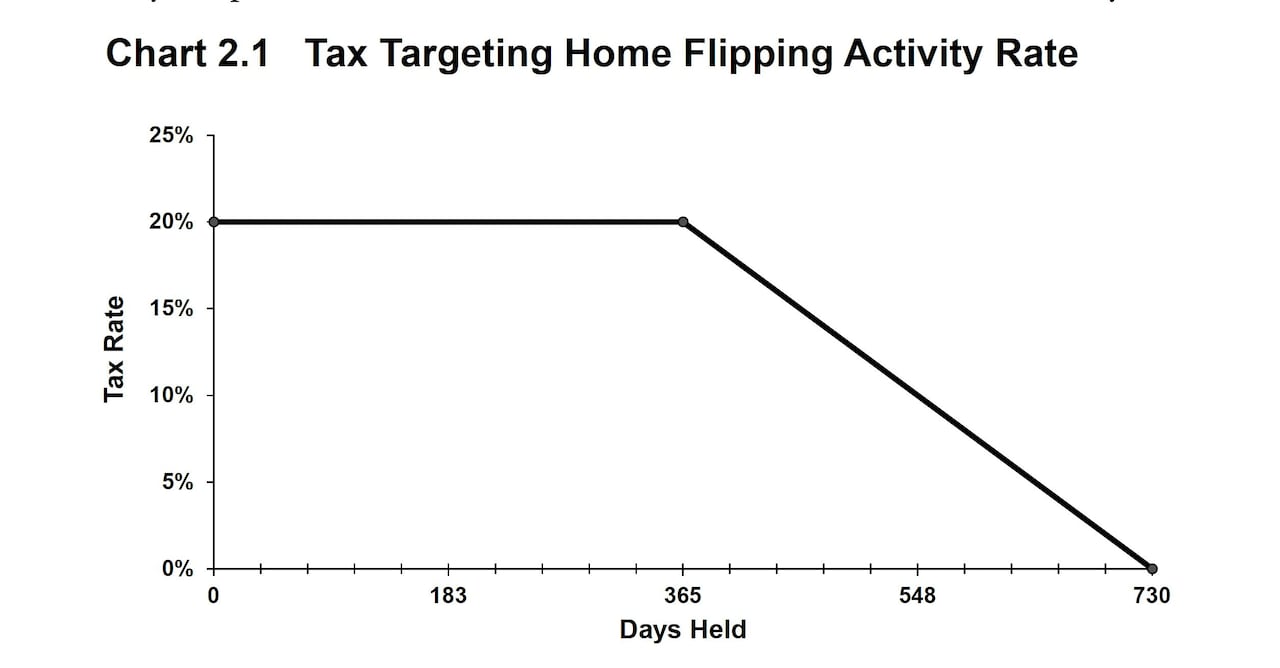

The B.C. government announced a 20 per cent tax on profit made by people who sell properties two years or less after purchasing it.

The tax will slide to zero between 366 and 730 days after the acquisition.

B.C. Finance Minister Katrine Conroy announced the tax as one of the province’s latest tools to try and curb speculation over housing, in a province where many struggle to afford appropriate shelter.

“Prices went up as governments stepped back and speculators moved in,” said Conroy during her speech presenting her latest budget in the Legislature.

“That’s why we’re bringing in a home-flipping tax as our latest measure to crack down on bad actors.”

The tax is one of 20 pieces of legislation the government plans to introduce this session, meaning it will need to be passed at some point over the next three months before becoming law.

The plan is to implement it for properties sold on or after Jan. 1, 2025. It will also apply to properties purchased before then.

Conroy’s 2024/2025 budget forecasts that the tax, once in place, would result in an additional $44 million in revenue in the 2025/2026 fiscal year.

That revenue will go directly to building affordable housing throughout the province, she said.

Budget documents from the B.C. government’s 2024/2025 budget, which include a new tax on people who sell their homes two years or less after purchasing them. (Maggie MacPherson/CBC News)

Homesellers would be taxed around 10 per cent after owning a home for a year and a half, with the tax lifted after ownership for 730 days or two years.

The tax will apply to income from the sale of properties with a housing unit and properties zoned for residential use. It also applies to income made from condo assignments.

It does not apply to land or portions of land used for non-residential purposes, according to the government’s budget documents.

Other exemptions under the tax include life circumstances such as separation, divorce, death, disability or illness, relocation for work, involuntary job loss, change in household membership, personal safety or insolvency.

“The purpose of this tax is to support housing supply, not impede it,” reads the government’s budget documents.

“Exemptions will be provided for those who add to the housing the supply or engage in construction and real estate development.”

The tax is to be paid in addition to any federal or other provincial income taxes incurred from the sale of property.

A chart from the 2024/2025 provincial budget shows how a tax on selling a new home two years or less from purchase would reduce over time. (Government of B.C.)

Alex Hemingway, a senior economist with the Canadian Centre for Policy Alternatives, said although the tax is another tool to try and address speculation, he’s not confident in how successful it will be.

“I think a flipping tax can take a little bit of air out of the tires in terms of speculation, but it’s not really getting at the root of the housing crisis, which is a shortage of housing overall and a shortage of non-market housing in particular.”

He also said the tax could inadvertently drive down house sales and transactions, siphoning tax revenue away from property transfers.

First-time homebuyer credit

The budget also introduced expanded property transfer tax exemptions, increasing the First Time Homebuyers Program threshold up to $500,000 on the purchase of a home worth up to $835,000.

The province says it would result in savings of up to $8,000 and double the amount of residents — approximately 14,500 — that will benefit.

The province will also waive the property transfer tax for eligible purpose-built rental buildings that have four of more units until 2030.

News Related-

The best Walmart Cyber Monday deals 2023

-

Jordan Poole took time to showboat and got his shot blocked into the stratosphere

-

The Top Canadian REITs to Buy in November 2023

-

OpenAI’s board might have been dysfunctional–but they made the right choice. Their defeat shows that in the battle between AI profits and ethics, it’s no contest

-

Russia-Ukraine Drone Warfare Rages With Dozens Headed for Moscow, Amid Deadly Winter Storm

-

Trump tells appeals court that threats to judge and clerk in NY civil fraud trial do not justify gag order

-

Can Anyone Take Paxlovid for Covid? Doctors Explain.

-

Google this week will begin deleting inactive accounts. Here's how to save yours.

-

How John Tortorella's Culture Extends from the Philadelphia Flyers to the AHL Phantoms

-

Tri-Cities' hatcheries report best Coho return in years

-

Wild release Dean Evason of head coaching duties

-

Air New Zealand’s Cyber Monday Sale Has the 'Lowest Fares of 2023' to Auckland, Sydney, and More

-

NDP tells Liberals to sweeten the deal if pharmacare legislation is delayed

-

'1,000 contacts with a club': Tiger Woods breaks down his typical tournament prep to college kids in fascinating video