Get 2024 started on the right financial footing (Credits: Getty Images)

January is a time when many of us think about getting financially fit for the year ahead.

Amidst the hustle, it’s worth remembering that small changes can make a big difference in your financial landscape.

If you have set aside some time this month to sort out your money, then here are some tips to get 2024 started on the right financial footing.

Track your money

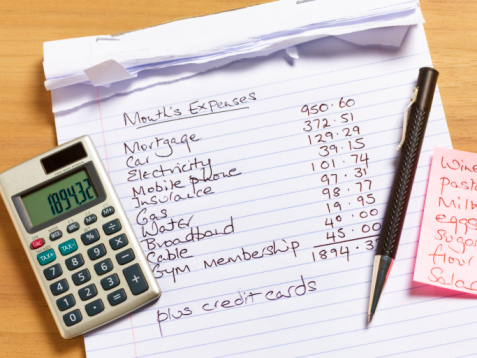

The best way to get started is to write everything down in one place so you can see exactly how much money goes in and out of your current account each month.

If you use online banking, your bank’s app might already label your spending into categories, such as entertainment, groceries and clothes shopping, so you can see an overview of your spending patterns and set budgets. Or you might find a budgeting app, such as Snoop, useful.

Start with a typical month – December or January often have unusual spending. Then gather up all your income (money you earn, benefits, gifts) and then look at everything you are spending.

Keep track (Credits: Getty Images)

Break down your spending into items you must spend on: rent/mortgage, utility bills, food, car, phone, childcare costs, debt repayments for example. Look at each one of these and check when the last time was you tried to get a better deal. Could you switch energy or phone supplier?

Then look at all your other spending, especially those costs coming out every month. Could you cancel any of these services – such as Netflix, or apps that you might have signed up to throughout the year? Many of these services have upped their prices recently – think about whether you are getting good value or whether there are cheaper alternatives.

Set a budget

Once you have a view of the money you earn and the money you spend, you can start to set a budget. If the money you spend is more than the money coming in, then you either need to get more income or cut your costs.

Could you find a better-paying job? Could you start a side hustle? Are you claiming all the benefits that you are entitled to?

Could you make a small change for your finances? (Credits: Getty Images)

When it comes to your spending, make sure you are covering all your essentials and then set monthly amounts for non-essential items. Making small, frequent changes can make a big difference.

If you are used to buying a £3 coffee from a shop every day, walking past instead of going in could save you £15 per week or a whopping £780 per year!

Create an emergency fund

You never know when your boiler might give up or your car might need urgent repairs, so it’s best, if you can, to have some money squirrelled away for emergencies.

Generally, it’s recommended that you have enough savings to cover six months’ worth of expenses, but having any sort of savings is a good start.

Again, it’s good to start the saving habit small. Just a few pounds a week into a savings account can make a difference and over time means you are building up your financial resilience.

Have some savings just incase disaster strikes (Credits: Getty Images/iStockphoto)

Build your credit score

A higher credit score can improve your chances of being approved for a credit card, loan or mortgage at more affordable rates, giving you more piece of mind when you apply.

To get a high credit score, you need a solid credit history that proves to lenders you’re able to manage your debts. Putting a few purchases on a credit card that you know you can afford to pay off each month can help build up your credit history, which will see your score improve over time.

If you are not a mortgage holder, apps such as CreditLadder can help you report your rental payments and improve your credit score.

Manage debt

Stay in control (Credits: Getty Images/iStockphoto)

Keeping your debt in check might feel like an uphill struggle, but there are steps you can take to feel more in control.

Your credit report can be a great way to start thinking through your debts. Have a look at your latest report and check whether everything you owe is listed.

Then mark each one of the ‘priority debts’ – things like your mortgage or rent, any loans secured against your home,plus your car, gas and electricity bills, and council tax.

Missing payments for any of these can have serious consequences. Other debts are ‘non-priority’, and you should pay at least the minimum on these.

Justin Basini is Group CEO and co-founder of ClearScore (Credits: Jenny Smith Photography)

There are two main ways to reduce debt: the first is to save enough money to pay down some of your debt; the second is to move your debt on to a cheaper deal. If you have some savings, you might want to consider using them to pay off debt. If you would like to cut down your debt by moving it to a cheaper deal, a balance transfer card or a debt consolidation loan might be a suitable option for you.

Recover lost accounts

There are services that help you track down old savings accounts and pension schemes. You could try Gretel, which is free and can help you find all types of financial assets, including lost pensions. Alternatively, the Pension Tracing Service on gov.uk can help.

Facing your finances might be the last thing you want to do right now, but you could find that putting steps in place to keep a close eye on your money leaves you feeling more positive about the year ahead.

Get your regular dose of need-to-know lifestyle news and features by signing up Metro’s The Fix newsletter

News Related-

High court unanimously ruled indefinite detention was unlawful while backing preventive regime

-

Cheika set for contract extension as another Wallabies head coaching candidate slips by

-

Analysis-West's de-risking starts to bite China's prospects

-

'Beyond a joke' Labor won't ensure PTSD protections: MP

-

Formula One season driver ratings: Lando Norris shines as Max Verstappen nears perfection

-

Catalina golfer Tony Riches scores Guinness World Record four holes in one on same hole

-

Florida coach Billy Napier fires assistants Sean Spencer, Corey Raymond with expected staff shakeup ahead

-

Rohingyan refugee NZYQ accidentally named in documents published by high court

-

Colorado loses commitments of 2 more high school recruits

-

Queensland Health issues urgent patient safety alert over national bacteria outbreak

-

Townsville Community Pantry 'distressed' by fruit, vegetable waste at Aldi supermarket

-

What Is The Beaver Moon And What Does It Mean For You?

-

Labor senator Pat Dodson to resign from politics due to health issues

-

Hamas releases 11 more hostages, as Israel agrees to extend ceasefire